– Grows Video Products Revenue 40% Year-over-Year

– Began Shipping Next-Gen Flagship Pro Audio Platform

– Increases Dividend; Renews and Extends Stock Repurchase Plans Reiterating Commitment to Shareholder Value

ClearOne (NASDAQ: CLRO), a global provider of audio and visual communication solutions, reported financial results for the three and twelve months ended December 31, 2016.

“Our underlying fundamentals held strong and set the stage for a better 2017; however, in the fourth quarter, several factors continued to negatively impact our financial results,” said Zee Hakimoglu, president and chief executive officer. “The transition to our next generation professional audio conferencing platform has taken longer than projected. To stimulate customer interest and sales in the current generation products, we reduced pricing on the CONVERGE® Pro 1. While we successfully spurred sales, revenue was still lower than prior periods and it negatively impacted gross margin. An overall weak global economy, including pressures caused by an uncertain political climate in Europe and the U.S. elections, further aggravated infrastructure and capital equipment spending and dampened our 2016 fourth quarter sales.”

“We are, however, pleased to report our efforts in video products contributed over $5 million in revenue and grew 40% year-over-year. In fact, video posted double digit year-over-year revenue growth for the ninth quarter out of the ten most recent. Also, while we began shipping a limited number of SKUs of CONVERGE Pro 2 in the fourth quarter, we are now shipping all 10 SKUs of the new audio platform as well as our award-winning Beamforming Microphone Array 2.”

“Looking ahead, we are building positive momentum in the first quarter of 2017. Already our revenue including backlog is tracking to the first quarter of 2016 and revenue from the new audio platform is well ahead of fourth quarter revenue. We believe the transition to our new audio platform is gaining traction. Our highly scalable and cost-effective audio, video conferencing and collaboration, and network media streaming products extend our addressable market to more workspaces and more businesses worldwide. To accelerate momentum in the market in 2017, we are focused on broadening our sales and marketing initiatives and activities. We are confident in ClearOne’s business and long-term positive prospects, as is our board of directors. In March 2017, the board increased the quarterly dividend by $0.02 per share to $0.07 per share as well as extended our stock repurchase program to $10 million over the next twelve months. These actions reiterate our commitment to creating long-term shareholder value,” concluded Hakimoglu.

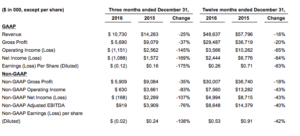

Financial Summary

The Company uses certain non-GAAP financial measures and reconciles those to GAAP measures in the attached tables.

- Q4’16 revenue was $10.7 million, compared to $14.3 million in Q4’15. The year-over-year reduction reflects the transition to the next generation professional audio conferencing platform launched in June 2016, price reductions to CONVERGE Pro 1 products and the weaknesses in capital expenditure spending in U.S. and other major markets.

- Gross profit in Q4’16 was $5.7 million, as compared to $9.1 million in Q4’15. Gross profit margin declined to 53% in Q4’16 from 64% in Q4’15, caused mainly by price reductions, increased overhead absorption due to reduction in inventory and scrapping of inventory related to wireless mics production transition. Non-GAAP gross profit margin was 55% in Q4’16 compared to 64% in Q4’15.

- Operating expenses in Q4’16 were $6.8 million, compared to $6.5 million in Q4’15.

- Net loss in Q4’16 was $1.1 million, or $0.12 per diluted share, compared to net income of $1.6 million in Q4’15, or $0.16 per diluted share. Non-GAAP net loss was $0.2 million in Q4’16, or $0.02 per diluted share, compared to $2.3 million in Q4’15, or $0.24 per diluted share.

Full Year 2016 Financial Results as compared to 2015

For the twelve months ended December 31, 2016, revenue was $48.7 million, compared to $57.8 million in 2015, reflecting a reduced demand for our products across most regions except parts of Asia. Net income was $2.4 million, or $0.26 per diluted share, compared to $6.8 million, or $0.71 per diluted share. Non-GAAP net income was $5.0 million, or $0.53 per diluted share, compared to $8.7 million, or $0.91 per diluted share. Non-GAAP Adjusted EBITDA was $8.6 million, compared to $14.4 million.

Continued Investment in Shareholder Value

During the fourth quarter of 2016, the Company paid a cash dividend of $0.05 per share and repurchased approximately 86,000 shares amounting to $0.9 million under its $10 million stock repurchase program announced in March 2016. As of Dec. 31, 2016, the Company has acquired approximately 542,000 shares amounting to $6.1 million under the stock repurchase program. The Company intends to continue to repurchase shares of its common stock, and in March 2017 the Company renewed and extended its stock repurchase program for up to an additional $10 million in the open market, subject to price, volume and other safe harbor restrictions over the next twelve months. After payments totaling $1.8 million for the dividend and stock and option repurchases during 2016, cash, cash equivalents and investments were $38.5 million at Dec. 31, 2016, as compared with $39.8 million at December 31, 2015. The Company continued to have no debt.